Discover how platforms that once revolutionized media consumption are now grappling with challenges reminiscent of traditional cable models.

COPYRIGHT © 2025 WELLPAL CREATIVE

How the SVOD Industry’s Quest for Dominance Recreated the Problems It Promised to Solve

This surge in on-demand content has led to a highly fragmented market with over 200 streaming platforms globally.

Disclaimer: Readers are advised to consider this information in conjunction with their own research and to verify any critical data points before making business decisions. These industry are dynamic, and actual results may differ materially from the projections and analysis presented here. Or reach out for more in-depth and tailored made research on the topic for your business. An overview of current streaming services, highlighting rising costs and increasing competition

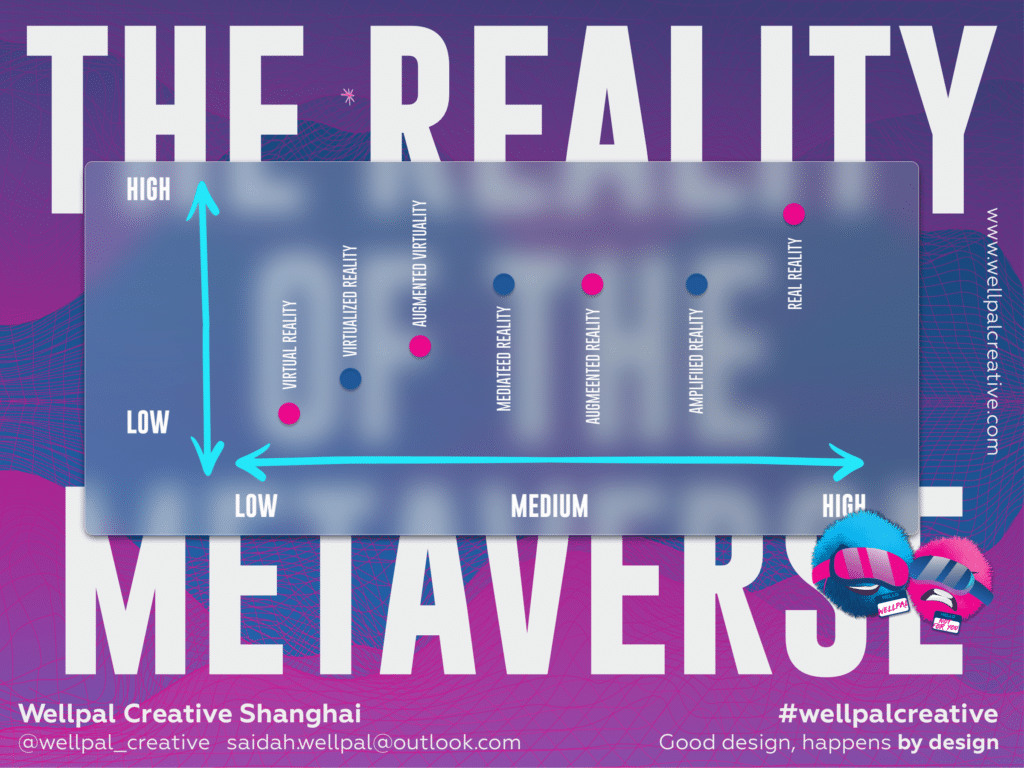

This shift isn’t just about population — it’s about asymmetric innovation.

Why this matters for all industries: Streaming’s growth map mirrors broader globalization trends—scale alone doesn’t guarantee success, but strategic localization does.

As we explore the current state of streaming services, it is essential to recognize the historical context that has shaped this landscape. The evolution of subscription models—from traditional cable services to individual streaming platforms, then to bundled offerings and now back to hybrid models—illustrates a cyclical journey influenced by consumer preferences and economic realities.

Expanded Analysis

The subscription model has undergone a fascinating evolution over the past few decades, transitioning from traditional cable services to individual streaming platforms, then to bundled services, and now back to hybrid models that include broadcast sports. This cyclical journey reflects not just changes in consumer preferences but also the underlying economic realities that challenge the sustainability of subscription-based businesses.

Why Stockpiling Content and Ignoring Price Resentment Could Turn Subscribers Into Mercenaries

"In the race to be everything to everyone, streaming services have become the overpriced buffet nobody asked for – and we’re all stuck with the mental indigestion."

The streaming industry’s playbook has quietly shifted from “more is better” to “less is… strategic.”

Let’s cut through the corporate speak: Streaming platforms are playing a dangerous game of chicken with their audiences.

Picture Netflix sitting on a vault of unreleased Stranger Things episodes like a kid hoarding Halloween candy – not because they’re not ready, but to time drops with Verizon’s latest bundle promo.

It’s the entertainment equivalent of your favorite café "strategically" running out of croissants to drive lunch traffic.

But here’s what they’re missing: Audiences aren’t lab rats. When HBO Max delayed The Last of Us Season 2 to juice quarterly numbers, fans didn’t twiddle their thumbs – they flocked to TikTok’s 90-second Sopranos fan edits and pirated archives.

The lesson? Artificial scarcity works for luxury handbags, and sneakers, not for content that’s supposed to be “always there.”

Here’s the uncomfortable truth nobody’s saying aloud: Your $19.99 Netflix plan now feels less like a steal and more like a shakedown.

But the real crisis isn’t the 50% production cost surge – it’s the simmering resentment as viewers realize they’re subsidizing Bob Iger’s third yacht.

Take Pakistan, where Netflix costs less than a street food lunch. Sounds generous until you realize local subscribers need 3x more work hours to afford it than they did in 2020.

So what happens? They’re VPN-ing to cheaper regions or treating Disney+ like a library card – binge Ahsoka in a weekend, cancel by Monday.

It’s not piracy; it’s protest.

And the platforms’ response? HBO Max making you play insurance ad mini-games mid-House of the Dragon for a 12% discount. Yes, really. Next they’ll have us solving CAPTCHAs to prove we’re human enough to watch Succession.

Meet your new subscribers: tactical, ruthless, and allergic to loyalty.

They’re using apps like SubGuard to auto-rotate services like stock traders flipping crypto. In Buenos Aires, AI tools cancel your Netflix 72 hours post-binge.

In Lagos, startups sell 50-cent daily passes to specific shows via WhatsApp.

This isn’t failure – it’s Darwinian adaptation.

Audiences have decoded the game: Why pay $20/month for 200 shows you’ll never watch when you can pay $2 for the one you actually want? It’s the revenge of the à la carte generation raised on Spotify singles and TikTok clips.

Streaming’s original sin was solving cable’s problems too well.

Unlimited content? Check. No ads? Done.

But in their gold rush to be everything to everyone, they recreated cable’s bloat with Silicon Valley smugness.

Yet in the cracks of this broken model, a revolution brews.

Warner Bros. dabbling in NFT episode ownership isn’t innovation – it’s desperation. The real pioneers are in Lagos living rooms and Karachi internet cafes, reinventing access models that make $19.99/month look as antiquated as Blockbuster late fees.

The Burning Question: When your subscribers become smarter negotiators than your C-suite, who’s really winning the streaming wars? Streaming’s open secret: "Feed the beast"—or risk losing the crowd.

The incompatibility between cost structures and subscription models represents perhaps the most stealthy risk.

As companies like Netflix grow their subscriber base, they face increasing pressure to produce quality content. While acquiring new subscribers may seem effortless at first—given the low marginal cost of streaming—the reality is that sustaining viewer engagement requires substantial investment in new content.

This creates a convex cost curve: as demand increases, so too do costs. The challenge lies in balancing revenue generation with content quality while managing subscriber expectations.

If companies cannot effectively allocate resources or isolate costs associated with new content, they may inadvertently stifle innovation and quality.

Netflix’s $7.99/month, ad-free model wasn’t just affordable—it was psychologically liberating.

By 2016, it amassed 75M subscribers by offering:

One-stop access: A unified library (licensed content + early originals like House of Cards).

Predictable pricing: No hidden fees or tiers.

Cultural cachet: “Cutting the cord” became a lifestyle statement.

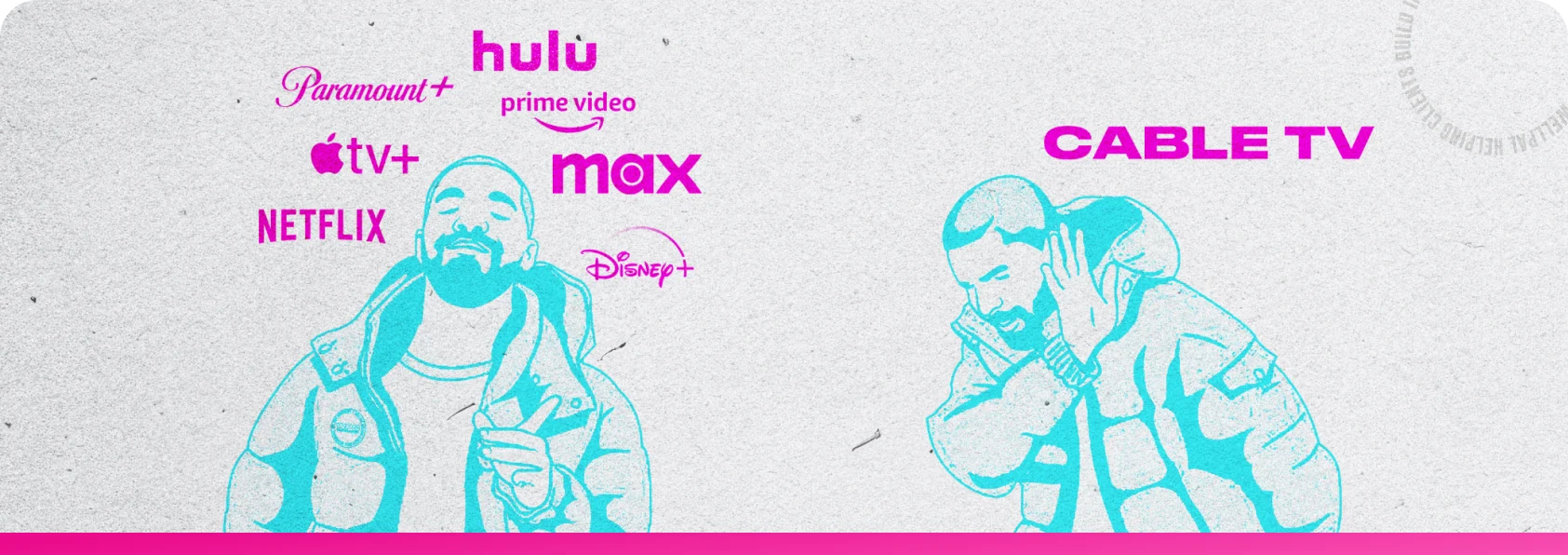

Why it worked: The model exploited cable TV’s rigidity. While cable providers fought for 5% annual price hikes, Netflix’s flat rate felt like a rebellion.

The Great Reclamation: Disney pulled Marvel, Star Wars, and Pixar from Netflix to launch Disney+ (2019). Warner Bros. removed Friends for HBO Max.

Password chaos: Password sharing continues to be a thorn in the side of streaming platforms, costing content providers an estimated $2.4 billion in lost revenue. The practice is particularly prevalent among younger generations, with Gen Z leading the charge. As of December 2023, over half of Gen Z adults admitted to accessing streaming services using someone else’s password. Millennials aren’t far behind, with 37% confessing to the same behavior. Overall, a solid 30% of U.S. adults are riding the streaming wave on someone else’s dime

The “Niche-ification” Trap: 200+ global platforms emerged, from Shudder (horror) to BritBox (British TV). “Choice” became a burden—47% of consumers resent “subscription hopping” (Deloitte, 2023).

The irony: Streaming’s democratization birthed a hierarchy. Exclusive content became the new “premium cable channel.”

Ad-supported tiers:

Ad-supported tiers are gaining traction: over 55% of Netflix’s Q4 2024 sign-ups in ad-supported markets chose its $7.99 ad-tier. Netflix doubled its ad revenue year-over-year in 2024 and expects to double it again in 2025.

Bundling redux:

Bundling is back: Streaming services are increasingly offering bundled packages, mirroring cable’s “package deals.” A Disney, Hulu, and Max bundle is available for $16.99/month with ads, offering up to 38% in savings.

Regional stacking:

Japan’s SVOD market is experiencing steady growth, driven by demand for premium and localized content. Users often combine services like U-Next (anime) + DAZN (sports) + Netflix, creating a digitized cable package.

A Return to Cable-Like Complexity

Ok. Let’s dive in a bit more. Remember when Netflix promised to free us from cable’s iron grip? Oh, so young and naive we were. Fast forward to 2024, and we’re juggling more subscriptions than a digital hoarder at a Black Friday sale.

Want to watch Stranger Things, The Last of Us, and Shōgun? That’ll be three different subscriptions, please—and don’t forget to set calendar reminders for when each show drops.

A Deloitte study found that 47% of consumers believe there are too many streaming services. Welcome to the streaming paradox, where more options somehow equal less convenience. Viewers are facing ‘decision paralysis’ due to the overwhelming amount of content scattered across platforms.

ROI or R.I.P.?

If you think your streaming bills are eye-watering, consider the platforms’ spending sprees. Disney casually dropped $25B on content in 2024—enough to buy several small islands or fund a space program. Netflix, not to be outdone, maintains its $17B annual content shopping habit. It’s like watching billionaires in a spending contest where everyone’s credit card is perpetually smoking.

But here’s the thing: bigger budgets don’t guarantee bigger hits. Amazon’s $1B Lord of the Rings series drew only half its target audience—proof that you can’t simply throw money at Middle Earth and expect viewers to materialize.

Meanwhile, Suits, a show from 2011 that cost a fraction of these mega-productions, became Netflix’s most-streamed title in 2023. It’s the streaming equivalent of spending a fortune on caviar only to watch guests devour the potato chips instead.

Remember when streaming was supposed to tear down walls? Instead, we’ve built digital castles with moats so wide you’d need a subscription bundle just to cross them. Each platform has become its own miniature kingdom, complete with proprietary data, exclusive content, and algorithms that know your viewing habits better than your significant other. A play out of Apple’s “Great iWall”?

These walled gardens aren’t just about keeping content in—they’re about keeping competitors out. Platforms guard their viewing data like Khaleesi’s dragons, releasing just enough statistics to brag about hits while burying any mention of their expensive flops. It’s a bit like Vegas: the house always wins, and nobody talks about their losses.

Download our free extended report to uncover how “analytics moats” protect billion-dollar kingdoms—and why your next binge-watch funds their walls.

*Instant access to full library of free/paid resources.

This asymmetry isn’t accidental—it’s strategic. Netflix’s APAC scripted commissions now account for 33% of its global total, surpassing North America. The region is projected to deliver 35% of Netflix’s subscriber growth through 2029.Yet challenges persist: while Korean dramas like Squid Game achieve global resonance, culturally specific hits like Indonesia’s Cigarette Girl thrive locally but rarely cross borders.

The streaming industry’s fragmentation isn’t just giving viewers a headache—it’s creating a fascinating domino effect of unintended consequences that would make even Netflix’s algorithm scratch its head.

Customer acquisition has become a costly game of musical chairs, with platforms essentially passing the same subscribers back and forth. The irony? They’re spending more to acquire customers who are increasingly likely to churn.

It's like hosting an elaborate dinner party where half the guests are already planning their excuse to leave early.

The content arms race has turned into a financial shit show. Studios are juggling skyrocketing production costs while trying to outbid each other for talent. A-list actors now command streaming premiums that would make traditional movie studios blush, and even mid-tier shows sport budgets that could fund small countries.

Rights management across regions has become so complex they practically needs their own limited series to explain it. Picture a global game of content Tetris, where shows appear and disappear across platforms and regions with all the predictability of a cat chasing a laser pointer.

One day you're binging your favorite show in Singapore, the next it's only available in Paraguay—with Lithuanian subtitles.

Marketing these exclusive shows has turned into its own special kind of chaos. Platforms are spending small fortunes to promote content that might be available for all of six months before vanishing into the digital ether.

As we stumble through this fragmented streaming landscape like digital nomads searching for the next hit show, the industry seems to be having its own existential crisis. Some platforms are finally admitting that maybe, just maybe, building walls isn’t the best way to make friends (or profits). In our report we explore this side of the moat as well (see page sample below).

We’re seeing the emergence of what could be called “frenemy bundles”—unlikely alliances between former rivals. Disney+ cozying up with Hulu and ESPN+ isn’t just convenient; it’s survival instinct dressed up as consumer choice. Meanwhile, ad-supported tiers are making a comeback faster than Y2K fashion, proving that everything old is new again (except maybe dial-up internet—some things should stay dead).

The future might not be in more walls, but in smarter bridges. Strategic content licensing, hybrid release strategies, and cross-platform partnerships are becoming less taboo and more table stakes. It’s as if the streaming giants are finally realizing that perhaps the real treasure isn’t in hoarding content like digital dragons, but in making it actually, you know, watchable.

WPC

Sai

Why viewers now treat subscriptions like bad Tinder dates – swipe right, binge, ghost, repeat

Remember when having a Netflix subscription made you feel like a digital sophisticate? Those days are as distant as DVDs-by-mail. Today’s viewers are drowning in a sea of subscriptions, juggling passwords like a circus act, and developing what psychologists might soon classify as “subscription selection anxiety disorder.”

Let's dive into this fascinating mess of modern streaming behavior.

Let’s call it what it is: Streaming has become a glorified gym membership. We sign up for the idea of cultural relevance, only to realize we’re paying $732/year (Deloitte, 2024) to rewatch The Office for the 14th time. Simon-Kucher’s 2024 study confirms the carnage: 42% of U.S. subscribers plan to cancel at least one service this year, not because they’re cheap, but because their brains can’t handle another “Which plan works for you?” pop-up.

This isn’t choice – it’s coercion. The average household now juggles 3.6 subscriptions, up from 3.2 last year, thanks to Netflix’s password crackdown turning shared accounts into breakup fuel. And here’s the kicker: 45% feel they’re drowning in subscriptions, yet keep adding more like moths to a blue-light screen. Why? Because FOMO now applies to TV shows.

WPC

Sai

The streaming industry’s dirty little secret? Churn rates that would give a rollercoaster engineer vertigo.

Modern viewers treat streaming services like disposable vapes – hit it hard, then toss it. Recent data shows 35% industry-wide churn rates, with Apple TV+ users ghosting at a “Bachelor finale-worthy” 40% rate.

It’s the streaming equivalent of a one-night stand—come for “The Bear,” and leave before breakfast.

This isn’t frugality. It’s revolt. When Gen Z would rather watch TikTok’s Succession parodies than pay for Max, you know the social contract’s broken.

Price sensitivity is becoming acute: According to recent Statista data, 40% of respondents worldwide cite wanting to save money as their main reason for terminating an SVOD subscription, while about one-third say the subscription is too expensive for what they get. Americans now pay an average of $61 a month for streaming services — that’s $732 a year according to a Deloitte report. When your combined streaming bills start approaching your utility payments, something’s got to give.

The impact is clear: Subscription hopping has become the norm, with consumers regularly pausing and canceling services. According to Simon-Kucher’s research, streaming service providers should expect churn rates of 20 to 40 percent even without raising prices, with subscribers already considering canceling their subscriptions within the next year. Apple TV+ faces the highest risk, with around 40% of existing subscribers planning to cancel.

This trend is particularly evident in price hike scenarios – research shows that a mere 10% price increase could result in 20% more subscribers canceling their service. When faced with the choice, many viewers are opting to become “subscription pausers” – canceling after watching specific shows and returning only when new must-watch content appears.

The purge came with hidden costs; a true trade-off.In India, where the basic plan costs 2.5 days’ wages for gig workers, the move sparked a surge in Telegram piracy channels. Even Disney+ saw 12% of U.S. users downgrade plans – the streaming equivalent of “It’s not you, it’s your pricing algorithm”

The lesson? You can monetize loyalty, but you can’t monetize resentment.

Here’s where it gets interesting: while big platforms wage their content wars, a revolution is brewing on “free” platforms. YouTube has become the Switzerland of streaming—neutral territory where independent creators are building media empires without selling their souls (or IPs) to the streaming giants.

Documentary creators, in particular, are finding that YouTube’s ad revenue + sponsorship model, while less lucrative upfront than a Netflix deal, offers something more valuable: control. They’re trading immediate paychecks for long-term IP ownership, like choosing to invest in real estate instead of renting a luxury apartment.

This isn’t about individual creators ‘making it’—it’s about a structural shift. Mid-sized YouTubers now earn 2-4x typical streaming licensing fees by owning their audiences. Whether you love or loathe their content, the economics are rewriting industry rules.

Let’s unpack a little more as to why creators are not necessarily swayed by the "glitter" of content creation for big streamers like Netflix.

The rise of YouTube as a documentary powerhouse reflects a fundamental shift in how creators approach storytelling—one where autonomy trumps corporate mandates, and audience connection outweighs algorithmic appeasement. This isn’t merely about platforms competing for views; it’s a reimagining of who gets to shape cultural narratives. Below, we explore the structural observations to what YouTube offers creators.

YouTube’s golden rule? You own your throne.

As long as you abide by the Terms of service of course. Unlike traditional media’s “sign here, surrender rights” model, YouTube treats creators as sovereign entities. This isn’t just legal jargon—it’s brand oxygen.

Licensing to Netflix often means handing over exclusivity rights, effectively shackling content to a single platform. For creators who’ve built empires on cross-promotion and multi-platform agility (think merch drops, podcast cameos, TikTok teasers), that’s a non-starter.

The Irony: Streaming platforms preach “originality” but demand creators dilute theirs. Imagine MrBeast’s extreme generosity stunts filtered through Netflix’s risk-averse content committees. Hard pass.

YouTube thrives on snackable authenticity—15-minute vlogs, shorts, raw tutorials, unscripted chaos. This is pretty much the current state of consumer behavior when it comes to media consumption.

Streaming? It’s the land of polished, binge-worthy sagas. This isn’t just a content clash—it’s a cultural divide.

YouTube: Algorithm-driven, personality-first, rapid-fire engagement.

Streaming: Cinematic narratives, studio gloss, “premium” storytelling.

The result? A YouTube creator’s “day in my life” vlog would flop on Netflix faster than Emily in Paris at a MMA fight.

YouTube’s monetization ecosystem is a multi-revenue hydra:

Compare that to streaming’s take-it-or-leave-it licensing deals. Sure, Netflix might cut a fat check upfront, but creators lose:

Case in Point: Emma Chamberlain’s caffeine-fueled rambles earn more via YouTube’s ad-replay model than any static streaming deal.

Now this is more of a "the price you pay for monetizing me" kind of observation.

YouTube audiences aren’t viewers—they’re ride-or-die tribes. Migrate content behind Netflix’s paywall, and you risk:

There have been many travel documentrary channels who learned the had way not to paywall the core content that earned them their subscribers. Subscribers are aware that their loyalty (the thing that made them grow their channel) should not be taken for granted.

Also… PewDiePie’s Minecraft rants on HBO? Not happening.

Example case: Kara and Nate’s 2020 decision to paywall their 100th-country documentary sparked immediate backlash, with their followers, accusing them of exploiting loyalty.

Subscribers felt betrayed—they’d supported the couple’s journey to 100 countries through ad views and engagement, only to be asked to pay $1 for the finale. The backlash forced them to apologize and remove the paywall, revealing two truths:

Audiences view free content as a social contract: Fans see their views/shares as currency. Monetizing key milestones breaks this implicit agreement.

Quality ≠ Monetization Rights: Even National Geographic-tier production (e.g., their Iceland glacier hikes) doesn’t entitle creators to retroactively charge for what audiences perceive as “owed” content.

Get in touch if you’re Looking to Transform market chaos into operational clarity through custom Brand Navigator™-filtered insights.

Devil’s Advocate Time: Licensing can be a Trojan horse for legitimacy.But here’s the rub: These wins are exceptions, not rules. For every successful crossover, 10 creators lose their magic in translation.

The Verdict: Independence Over Illusion

The streaming giants want your content—but not your chaos.

YouTube’s top talent aren’t just resisting; they’re rewriting the playbook. Why?

Until streaming platforms stop treating creators as content sharecroppers, YouTube’s throne remains unchallenged.

The lesson? Never trade your crown for someone else’s castle.

TikTok and YouTube Shorts aren’t just stealing attention—they’re rewiring viewer expectations. When viewers are used to 3-minute dopamine hits, asking them to commit to an 8-episode season becomes like suggesting they learn Sanskrit—theoretically enriching, but practically challenging.

The numbers tell the story:

(... Sometimes)

Smart platforms are finally realizing that keeping subscribers requires more than just throwing content at the wall to see what sticks. Successful retention strategies now include:

The streaming behavior landscape continues to evolve faster than you can say "Are you still watching?" The winners will be those who understand that in the attention economy, respect for viewers' time (and wallets) might be the ultimate competitive advantage.

Uncover the forces reshaping the economics of streaming. In this report, we analyze the escalating costs of content production and acquisition, and explore the strategies SVOD platforms are using to adapt. From the rise of ad-supported tiers to innovative revenue models, we examine the path forward for SVOD in an increasingly competitive landscape

Learn how your business might require thoughtful design and strategy to engage effectively

Below are some additional resources on the topic.

Uncover the forces reshaping the economics of streaming. In this report, we analyze the escalating costs of content production and acquisition, and explore the strategies SVOD platforms are using to adapt.

Ready to put your brand to work? Our interactive workbook, inspired by the streaming revolution, provides actionable exercises and frameworks to transform your brand into a growth engine.

Dive into our latest Lemon Seed, where we dissect the seismic shifts in the streaming industry and uncover the strategies platforms are using to achieve long-term sustainability.

find out below or contact me.

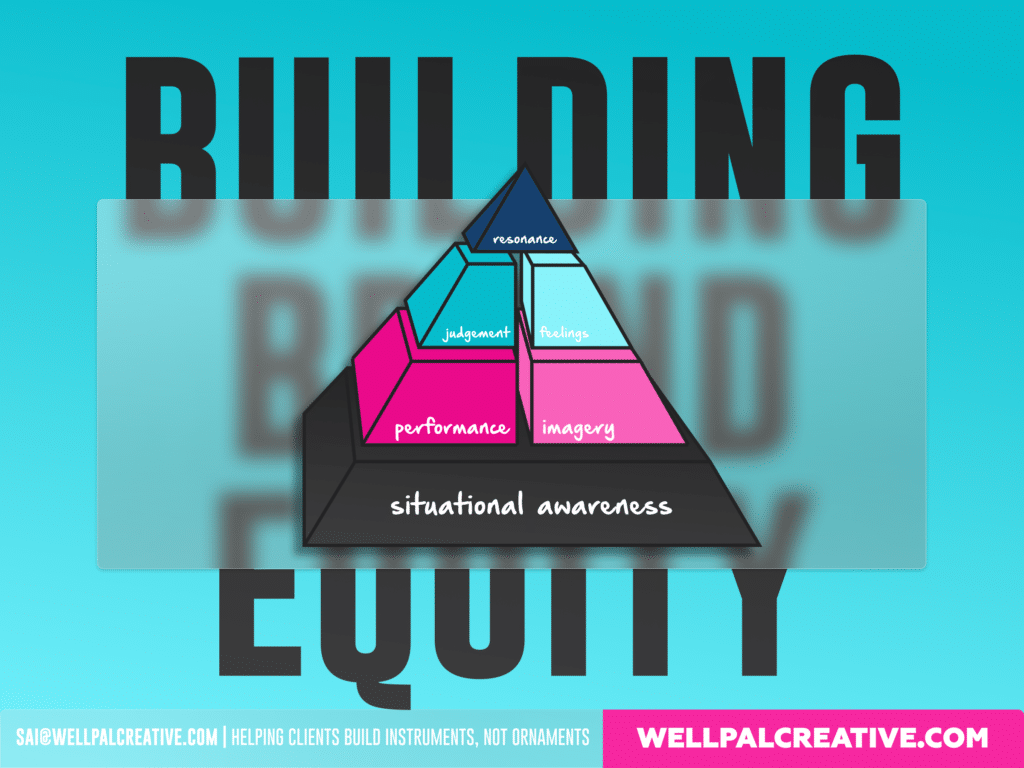

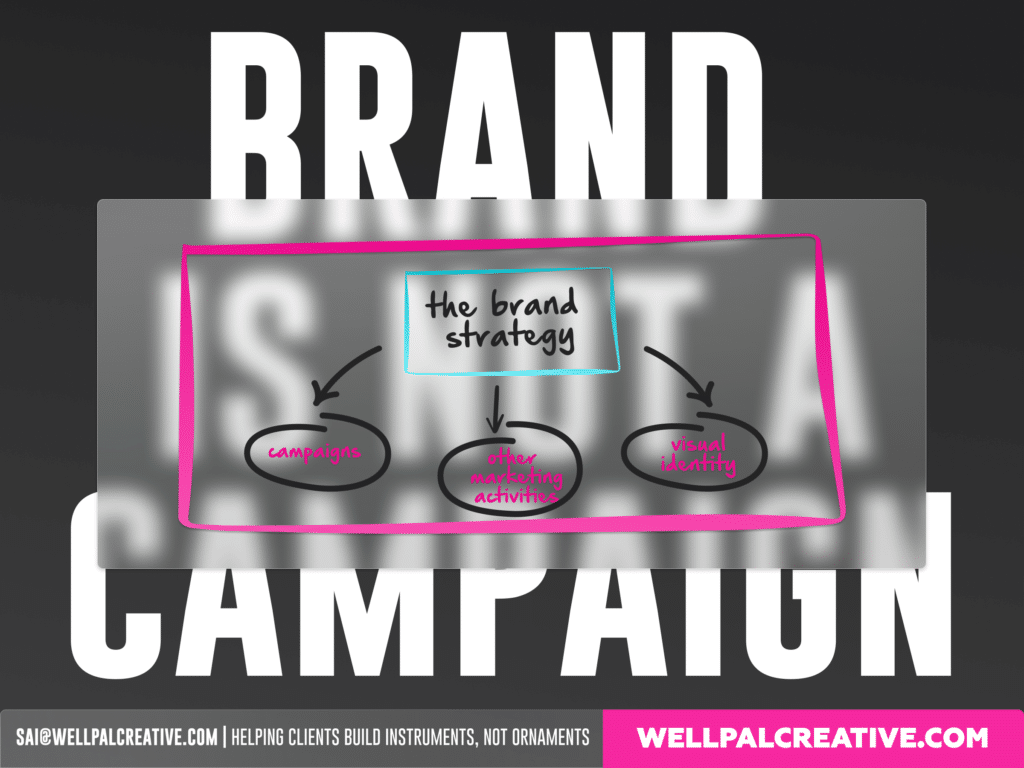

In the rapidly changing streaming landscape, companies face numerous challenges, from rising production costs and subscription fatigue to the need for innovative content strategies. WellPal’s Brand Evolution Suite™ is designed to help clients navigate these complexities and position their brands for success in an increasingly competitive market.

At WPC, we’ve designed our Solution Suite to help businesses navigate the balance between current trends and long-term business strategies:

In this fast-evolving landscape, success belongs to those who can strike this perfect balance between automation and authenticity—leveraging technology without losing sight of what makes their brand truly resonate with people.

For WPC I have developed numerous tools like our Solution Matrix and Brand Business Navigator, to help you identify where new technology adds value and where human ingenuity remains irreplaceable.

Check out the solutions and their links in more depth below, or contact me for more tailor-made advice and solutions.

WellPal Ideation & Prototyping (WIP)™ is designed for dreamers and doers alike. Whether you're a startup looking to disrupt the market, a new business aiming to refine your brand, or an established company exploring new horizons, i’m here to help bring your vision to life.

At the heart of the WPC Solution Suite is the Brand Nav approach, a brand business model tailored for elevating brand equity beyond just the operational aspect. Unlike traditional models, our Blueprint Navigator intricately blends strategic business insights with emotional customer engagement, ensuring your brand not only resonates but also endures.

WellPal Brand Evolution Suite™ is designed for brands at a crossroads, contemplating a fresh direction. Whether you're a brand who needs an identity refresh, or an established company exploring new horizons, or simply looking for strategic clarity in the clutter, i’m here to help bring your vision to life.

WellPal Brand Visuals is simply the design and graphic aspect of the solution suite. It's for brands craving visual distinction. Beyond aesthetics, we craft visuals that encapsulate your essence, making every interaction across multiple touch points memorable. Brand identity design, visual identity design, UI Design and development, GFX design

THE WELLPAL BUSINESS & BRANDING BLOG