COPYRIGHT © 2025 WELLPAL CREATIVE

“Build Instruments. Not Ornaments”

Featured

-

Couche-Tard Acquisition Strategy - Deep Dive Report

$290.00Original price was: $290.00.$200.00Current price is: $200.00. -

411 - NOLO Market

$30.00Original price was: $30.00.$15.00Current price is: $15.00.

Recent Lemon Seeds

Copyright © 2025|2026 WellPal Creative

Into the Ether

Ethereum 101: Expanding on Bitcoin's concept, facilitating digital assets and applications via smart contracts.

Velocity of Ether

In a simplistic view it can be broken down in 3 aspects:

- 1-side – Frozen

- Middle – Liquid

- 1-side – Gas evaporated

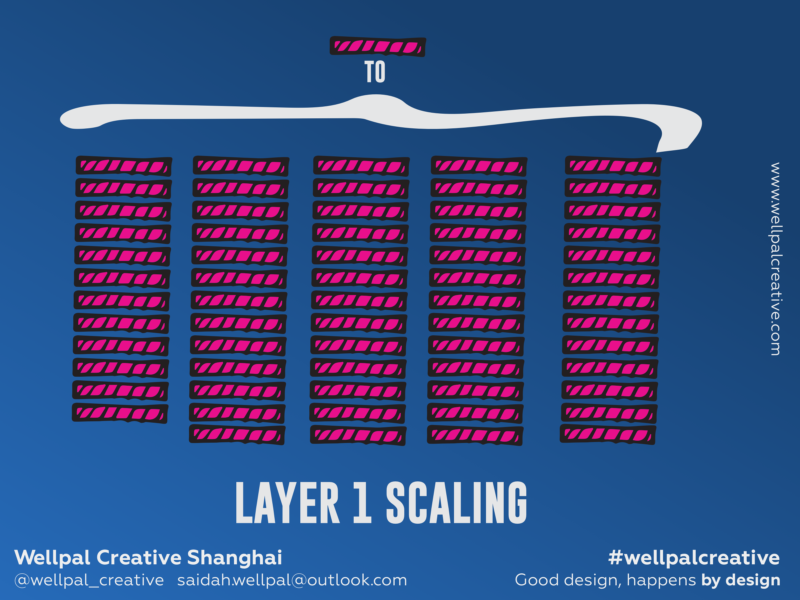

*see our WellPal visual below

FUNDAMENTALS

Ehtereum is a Layer 1 blockchain just like Bitcoin.

Ethereum however, has an entirely different design intention from that of Bitcoin.

Bitcoin functions more as a digital money network that is limited in its ability to accommodate multiple types of digital assets and applications built on top of it.

Ethereum, in comparison, is designed to integrate digital assets and applications through the use of unchangeable, blockchain-based smart contracts (these are coded to have self-executing actions; “IF” is met, “THEN” X will happen).

The currency we use to pay for the fees to interact with these smart contracts on Ethereum is called ETH (or Ether).

This payment itself is referred to as “gas”.

Ethereum’s evolution from “Proof of work” to “Proof of stake”. WHAT does it even mean??

When you come across the terms Ethereum 1.0 and 2.0, they connect back to this evolution.

To be clear #1: Ethereum 2.0 did not necessarily REPLACE Ethereum 1.0 (as we would most of the time think when something is named this way). It is more of a compounding effect, 1.0 was the lego block needed for 2.0 to be build upon.

That said, let’s dive a little deeper.

Part 1: Scaling of ethereum efficiency and throughput

Layer 1 – upgrading the ethereum blockchain to be more powerful (more with more)

Move from a single blockchain to 64… Basically it is making the blockchain more powerful through “more with more” .

Eg. if its now 1 computer, it will have to be upgraded to 64 with internet connection.

The solution to doing this is to switch from using a set of validators (currently at about 222,000 validators) and letting all validators validate the same blockchain, to sample SRC (statistically representative committees) at random to represent the entire set and let them validate different blockchains (called Shards).

Layer 1 expected optimization: 100x

Layer 2 – doing more with less (using current resources more efficiently)

Goal: Minimize the cost of execution

Direction 1 – to use cryptography

Take a batch of transactions and instead of run each transaction individually, we construct a off-chain cryptographic proof, to proof that all these transactions are valid. The off-chain validation (instead on o-chain) aspect of it is to reduce cost as this is much cheaper to do.

Direction 2 – optimistic execution

Take the batch of transaction and put them on-chain, but don’t execute them.

Taking bonded executioners (they stake x amount of ETH) who will make “claims” about these transactions. These executioners pretty much request “trust” that they are capable of running their transaction.

What if they are not capable in the end?

There is a 7-day (or otherwise stated) dispute period where anyone can challenge the “claim”. The “judge” in this scenario is the “blockchain”. It will pass judgement for there to have been “fraud” or not and instruct to amend/correct the error/fraud.

Both options are expected to result in 100x improvement each.

Goal is to compound them on top of each other and generate a 10,000x scalability.

There are already different layer 2 solutions in place, utilizing 4 main categories built on our directions above:

- Sidechains also sometimes called plasma chains (ex. Polygon, OMG Network,..)

- State Channels, simplified these are similar to a pre-paid card, Gas is paid when opening and closing only. Transactions within your pre-paid amount don’t require individual gas.

- Roll-ups, Simplified, they execute smart contracts outside of layer 1 (main chain) but the transaction data is posted on layer 1, the main chain (*see WellPal simplification visual above).

Fundamental problems like scalability need to be addressed first before thinking of the application layer of this technology.

In Part 2 we will dive a little deeper into the velocity of ETH, by breaking down the 3 states of ETH as Money.

Subscribe to be notified when part 2 is released.

Or check out new posts on my mirror.xyz page.

Are you ready to start looking at building brands or expanding product categories/portfolios with business and not just visual identity in mind?