COPYRIGHT © 2025 WELLPAL CREATIVE

“Build Instruments. Not Ornaments”

Featured

-

411 - NOLO Market

$30.00Original price was: $30.00.$15.00Current price is: $15.00. -

DIY Series - The MVB Kit

$25.00

Recent Lemon Seeds

Copyright © 2025|2026 WellPal Creative

The Seven & i Holdings Strategic Transformation

series 1

executive summary

The convenience store industry in the United States is undergoing significant transformation, driven by changing consumer behaviors, technological advancements, and strategic corporate maneuvers. Seven & i Holdings, the parent company of 7-Eleven, faces a potential acquisition bid from Canadian giant Alimentation Couche-Tard, setting the stage for a potential reshaping of the global convenience store landscape.

The U.S. convenience store industry has shown remarkable resilience and growth over the past decade. In 2023, industry sales reached $181.9 billion, marking a 4.8% increase from 2022. This growth is particularly impressive considering the challenges faced during the COVID-19 pandemic and the subsequent economic uncertainties. The industry’s ability to adapt to changing consumer needs, such as increased demand for contactless services and expanded food offerings, has been crucial to its success.

7-Eleven has maintained its position as the clear market leader with a 13.7% market share and 12,763 stores as of 2023. This dominance is the result of decades of strategic expansion and adaptation to local markets across the United States. The company’s growth strategy has included both organic expansion and significant acquisitions, such as the purchase of Speedway in 2021, which added thousands of stores to its network.

Furthermore, the industry is seeing a trend toward consolidation, with major players expanding through acquisitions. This trend is driven by the need for economies of scale in an increasingly competitive market. Smaller regional chains are often the targets of these acquisitions, as larger companies seek to expand their geographic footprint and increase their market share.

Technological innovations have become key differentiators in the convenience store sector. The implementation of sophisticated mobile apps, loyalty programs, and in-store technologies like self-checkout kiosks are reshaping the customer experience. Additionally, the integration of EV charging stations, particularly by forecourt retailers, is positioning convenience stores at the forefront of the transition to electric vehicles.

These developments are occurring against a backdrop of changing consumer preferences and behaviors. The pandemic has accelerated trends such as increased demand for healthier food options, contactless payment systems, and delivery services. As the industry moves forward, its ability to continue adapting to these evolving consumer needs will be crucial for sustained growth and profitability.

Continue reading a free preview of the Deep Dive below, or proceed to purchase the full report (including this preview) in PDF format.

Couche-Tard Acquisition Strategy – Deep Dive Report

what are deep dives

who is this for?

Deep Dives are designed for brand strategists, business leaders, and curious minds who crave a deeper understanding of the forces driving brand and business decisions in today’s complex global marketplace.

We don’t just report on what’s happening; we analyze why it matters, how it impacts the broader business ecosystem, and what it means for the future of branding and corporate strategy.

what sets them apart from other industry reports?

Multidisciplinary Approach

The Deep Dive Report offers a comprehensive analysis that goes beyond surface-level insights. It combines rigorous financial analysis with nuanced cultural insights and brand architecture expertise. This multidisciplinary approach allows for a deeper exploration of complex brand stories and business strategies, providing a holistic view of pivotal moments in brand evolution and corporate strategy.

Contextual Understanding

Unlike traditional reports that may focus solely on financial metrics, the Deep Dive Report examines the interplay between market forces, corporate culture, brand architecture, and strategic decision-making. This provides readers with a contextual understanding of how companies navigate complex challenges and opportunities, making it a valuable tool for understanding the broader business landscape.

Forward-Thinking Analysis

The report doesn’t just report on what’s happening; it analyzes why it matters, how it impacts the broader business ecosystem, and what it means for the future of branding and corporate strategy. This forward-thinking analysis is designed for brand strategists, business leaders, and curious minds who crave a deeper understanding of the forces driving brand and business decisions in today’s complex global marketplace

what are they?

We peel back the layers of intricate brand stories and business strategies that shape our world. This series goes beyond surface-level analysis, offering a multidisciplinary exploration of pivotal moments in brand evolution and corporate strategy.

In each Deep Dive, we dissect high-stakes business scenarios, mergers, acquisitions, and brand transformations that are reshaping industries. Our approach combines rigorous financial analysis with nuanced cultural insights, brand architecture expertise, and forward-thinking strategic perspectives.

disclaimer

This Deep Dive report is designed to provide a multidisciplinary analysis of complex brand stories and business strategies.

While we draw upon industry data and financial information, this report is not intended to be a comprehensive financial analysis or investment advice.

The insights and opinions expressed in this report are based on our analysis and interpretation of available information.

They may not reflect the views of the companies discussed or the broader industry consensus. Readers should consider this report as one of many tools for understanding the business landscape and should not rely solely on it for making business or investment decisions.

table of content

Background

Seven & i Holdings Company Profile

Seven & i Holdings, established in 2005 and headquartered in Chiyoda, Japan, has grown to become a global retail powerhouse. The company’s journey began with the merger of Ito-Yokado Co., Ltd. and Seven-Eleven Japan Co., Ltd., creating a diversified retail group that spans convenience stores, supermarkets, department stores, and financial services.

In the fiscal year 2022, Seven & i Holdings reported global revenue of $104.17 billion, showcasing its significant market presence. The company’s growth strategy has been marked by both organic expansion and strategic acquisitions, particularly in its convenience store segment. The acquisition of Speedway in the United States in 2021 for $21 billion was a landmark move that significantly expanded 7-Eleven’s footprint in the North American market.

Seven & i’s convenience store operations, particularly 7-Eleven Japan, have been a cornerstone of its success. In FY 2022, 7-Eleven Japan generated net sales exceeding 5 trillion yen, highlighting the brand’s strong position in its home market. The company’s success in Japan is attributed to its innovative approach to convenience retailing, including the introduction of fresh food offerings and private-label products.

As of FY 2023, Seven & i operates over 21,500 stores in Japan, demonstrating its extensive reach in the domestic market. This vast network has allowed the company to maintain its leadership position despite increasing competition and changing consumer preferences.

Alimentation Couche-Tard Company Profile

Alimentation Couche-Tard, a Canadian multinational operator of convenience stores, has emerged as a formidable player in the global convenience store industry. Founded in 1980 in Laval, Quebec, the company has grown from a single store to become the second-largest convenience store operator in North America.

Couche-Tard’s growth strategy has been characterized by aggressive expansion through acquisitions. Notable acquisitions include the purchase of Circle K from ConocoPhillips in 2003, which significantly expanded its presence in the United States, and the acquisition of Statoil Fuel & Retail in 2012, which marked its entry into the European market.

In the United States, Couche-Tard operates primarily under the Circle K brand. As of 2023, the company holds a 5.1% market share in the U.S. with 5,716 stores. This significant presence is the result of both organic growth and strategic acquisitions over the past two decades.

Couche-Tard’s approach to convenience retailing focuses on operational efficiency, innovative product offerings, and adapting to local market needs. The company has been at the forefront of implementing new technologies in its stores, including advanced payment systems and customer loyalty programs.

The Acquisition Bid

Initial Offer and Rejection

In April 2023, Alimentation Couche-Tard made an unsolicited bid to acquire Seven & i Holdings, valuing the company at approximately $38-40 billion. This bold move by the Canadian convenience store giant signaled its ambition to become a truly global player in the industry.

Seven & i’s board of directors swiftly rejected the offer, stating that it “grossly undervalues” the company’s true worth and potential. This rejection highlighted the confidence Seven & i’s leadership has in its own growth strategy and the value of its assets, particularly the 7-Eleven brand.

A key concern raised by Seven & i was the potential for regulatory hurdles, especially in the United States. Both companies have significant operations in the U.S. convenience store market, and a merger could potentially face antitrust scrutiny. This concern underscores the complex regulatory landscape that major international mergers must navigate.

Revised Offer and Seven & i's Response

Undeterred by the initial rejection, Couche-Tard returned with a revised offer in October 2023. The new bid valued Seven & i at $18.19 per share, bringing the total valuation to approximately $47 billion. This substantial increase of nearly $9 billion demonstrated Couche-Tard’s strong desire to complete the acquisition and its belief in the potential synergies between the two companies.

In response to this revised offer, Seven & i announced the formation of a special committee to evaluate the proposal. This more measured approach suggests that the company is taking the offer seriously and conducting due diligence to determine if it aligns with shareholder interests.

The ongoing negotiations have sparked significant market speculation about potential outcomes and their impact on the global convenience store industry. Analysts are closely watching for signs of whether the deal will go through and how it might reshape the competitive landscape.

recent trends & developments

trends

- Digital Transformation:

Major chains are investing heavily in mobile apps and cashless payment systems. Seven-Eleven's app, for instance, offers personalized promotions and seamless integration with their loyalty program. - Foodservice Expansion:

Convenience stores are increasingly focusing on fresh, prepared foods to compete with quick-service restaurants. FamilyMart has been particularly innovative in this area, introducing gourmet coffee and expanding its fresh food offerings. -

Sustainability Initiatives:

Chains are implementing eco-friendly practices, such as reducing plastic usage and food waste. Lawson has set ambitious targets for reducing CO2 emissions and increasing the use of renewable energy in its stores. - EV Charging Stations:

As electric vehicles gain popularity, convenience stores are beginning to install charging stations, particularly at locations with parking facilities. - Private Label Growth:

Chains are expanding their private label offerings to improve margins and differentiate themselves. Seven-Eleven's "Seven Premium" line has been particularly successful, spanning various product categories. - Consolidation:

The industry continues to see mergers and acquisitions as larger players seek to expand their geographic footprint and achieve economies of scale. - International Expansion:

While focusing on domestic market optimization, some chains are also looking abroad for growth. Seven-Eleven, in particular, has been expanding its global footprint. - Labor Shortages and Automation:

To address ongoing labor shortages, chains are experimenting with unmanned stores and increased automation in inventory management and checkout processes. - Loyalty Programs:

Sophisticated, app-based loyalty schemes that offer personalized rewards and gamification elements are becoming increasingly important for customer retention.

developments

- In 2023, Seven & i Holdings (parent company of Seven-Eleven Japan) announced plans to change its name to "Seven & i Holdings" to "7-Eleven Corporation," signaling a strategic focus on its convenience store business.

- FamilyMart has been experimenting with unmanned stores, launching its first fully automated convenience store in 2023.

- Lawson has partnered with Uber Eats to expand its delivery services, responding to increased demand for convenience and at-home consumption.

purchase full report

Why consider this?

- The Deep Dive Series provides contextual understanding of how companies navigate complex challenges and opportunities. It examines the interplay between market forces, corporate culture, brand architecture, and strategic decision-making

- Designed for brand strategists, business leaders, and curious minds seeking a deeper understanding of the forces driving brand and business decisions in today's complex global marketplace.

- The Deep Dive Series offers a multidisciplinary exploration of complex brand stories and business strategies. It goes beyond surface-level analysis by dissecting high-stakes business scenarios, mergers, acquisitions, and brand transformations that are reshaping industries

Difference with lemon seeds?

- Focus on Simplicity:

Lemon Seeds likely offers more straightforward insights or analyses that are easier to digest for a broader audience. It might focus on key takeaways or simplified strategies without delving into the intricate details that the Deep Dive Series covers. - Different Target Audience:

Lemon Seeds may cater to individuals or businesses looking for quick insights or actionable strategies without the need for deep exploration or comprehensive analysis.

Couche-Tard Acquisition Strategy – Deep Dive Report

Interested to see how WPC can help you?

find out below or contact me.

-

1 solution

WPC Ideation & Prototyping (WIP)™

WellPal Ideation & Prototyping (WIP)™ is designed for dreamers and doers alike. Whether you're a startup looking to disrupt the market, a new business aiming to refine your brand, or an established company exploring new horizons, i’m here to help bring your vision to life.

-

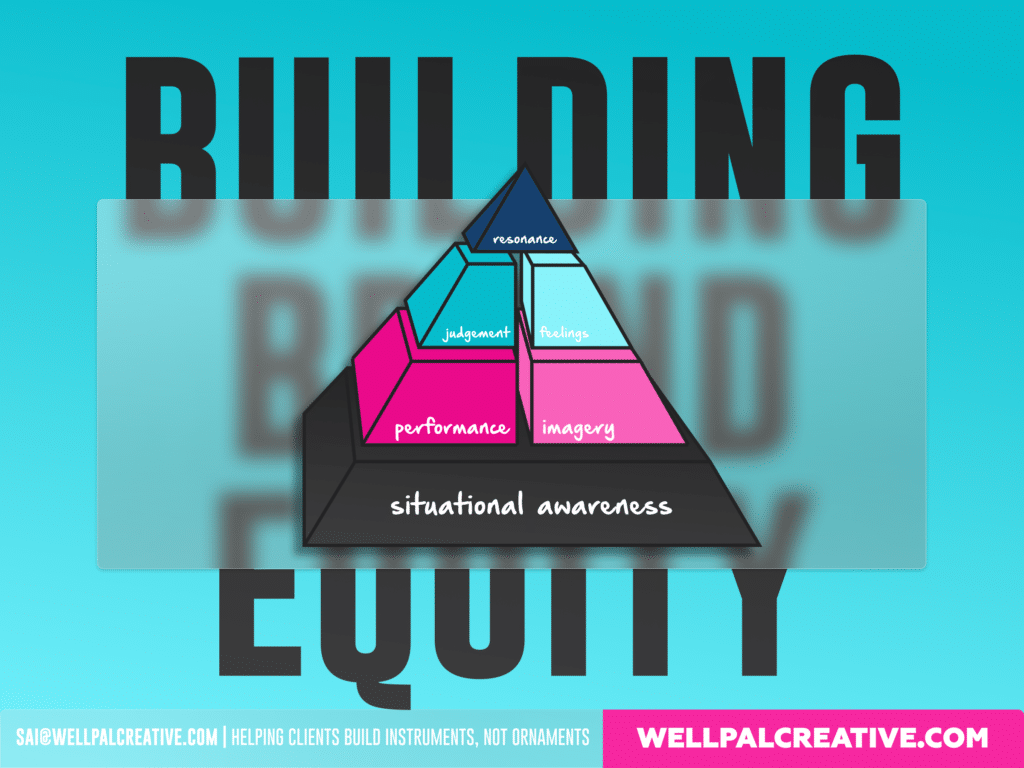

2 solution

WPC Brand Navigator™

At the heart of the WPC Solution Suite is the Brand Nav approach, a brand business model tailored for elevating brand equity beyond just the operational aspect. Unlike traditional models, our Blueprint Navigator intricately blends strategic business insights with emotional customer engagement, ensuring your brand not only resonates but also endures.

-

3 solution

WPC Brand Evolution Suite™

WellPal Brand Evolution Suite™ is designed for brands at a crossroads, contemplating a fresh direction. Whether you're a brand who needs an identity refresh, or an established company exploring new horizons, or simply looking for strategic clarity in the clutter, i’m here to help bring your vision to life.

-

4 solution

WPC Visuals

WellPal Brand Visuals is simply the design and graphic aspect of the solution suite. It's for brands craving visual distinction. Beyond aesthetics, we craft visuals that encapsulate your essence, making every interaction across multiple touch points memorable. Brand identity design, visual identity design, UI Design and development, GFX design

MORE LEMON SEEDS

THE WELLPAL BUSINESS & BRANDING BLOG

AI Strategy Delusion: Why 98% Fail at Coordination

Change the Game

AI’s Role in Building Brand Equity

The Streaming Paradox: Convenience vs. Complexity – [LS18 ]

From Hype to Hallucination: How AI Is Transforming Branding, Strategy, and Business – [LS17]

How to leverage Brand: Lessons from Seven&I Holdings – [LS16]

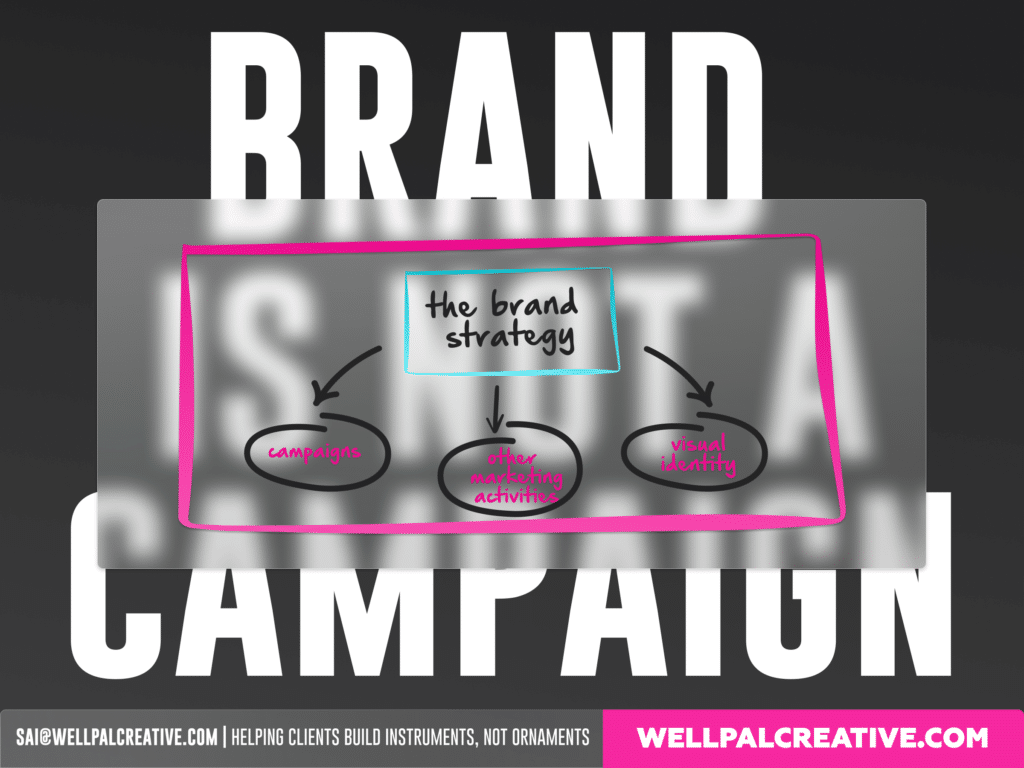

Impactful brand strategy isn’t a sprint, but a marathon – [LS12]

How to Build for brand equity- [LS10]

Brand is not a campaign- [LS9]

The Seven & i Holdings Strategic Transformation (DEEP DIVE)

How to understand Brand DNA: LEGO and Benetton Case – [LS15]

How to leverage open source for brand building – [LS14]

Blow up the silo – [LS13]

The digital 3rd place- [LS11]

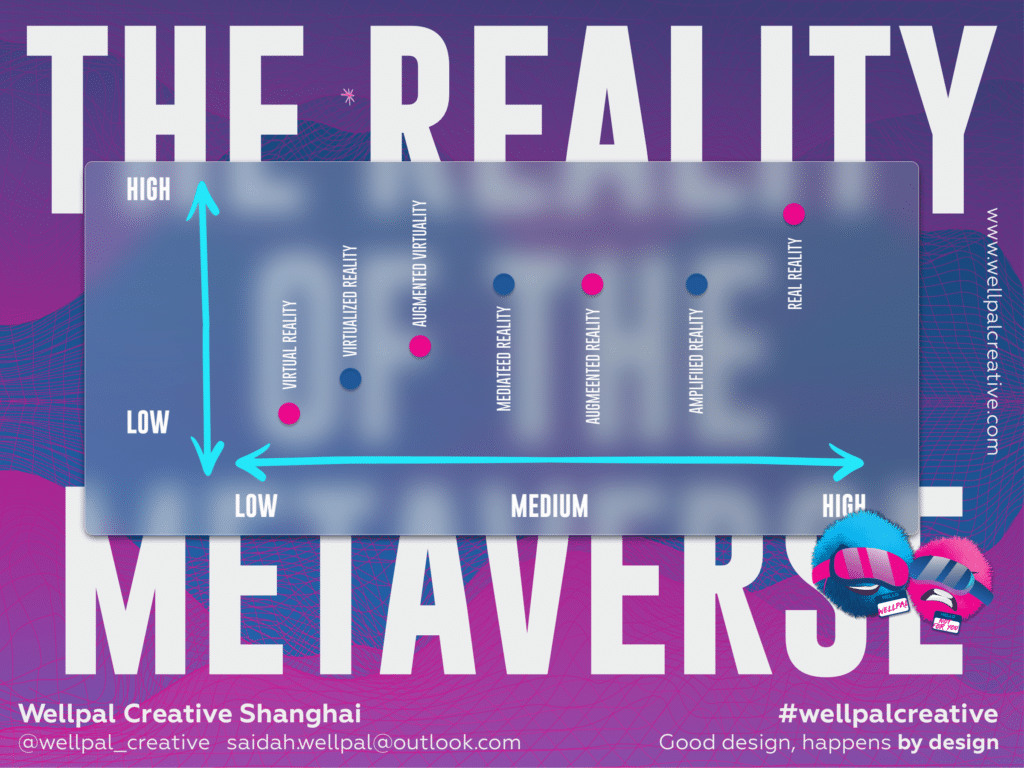

What’s the reality of it? – [LS8]

The Great iWall – [LS7]

Why you should care that they don’t need a lawnmower [LS6]

Why you should care about what shapes your brand [LS5]

Idea Legos- [LS4]